Bpi makes opening a deposit account easier on the pocket through its savings accounts with a low required initial deposit and maintaining balance.

Open bank account online no deposit philippines.

While you will always be required to show.

The two allow users to open an account and deposit checks completely online relying on artificial intelligence to confirm identities and documents.

200 pesos initial deposit.

Opening an account to open a bank account in the philippines you must visit the bank in person with several identification documents in hand.

Complete the online account opening form today and schedule an appointment with your chosen branch.

Account comes with an atm or debit card.

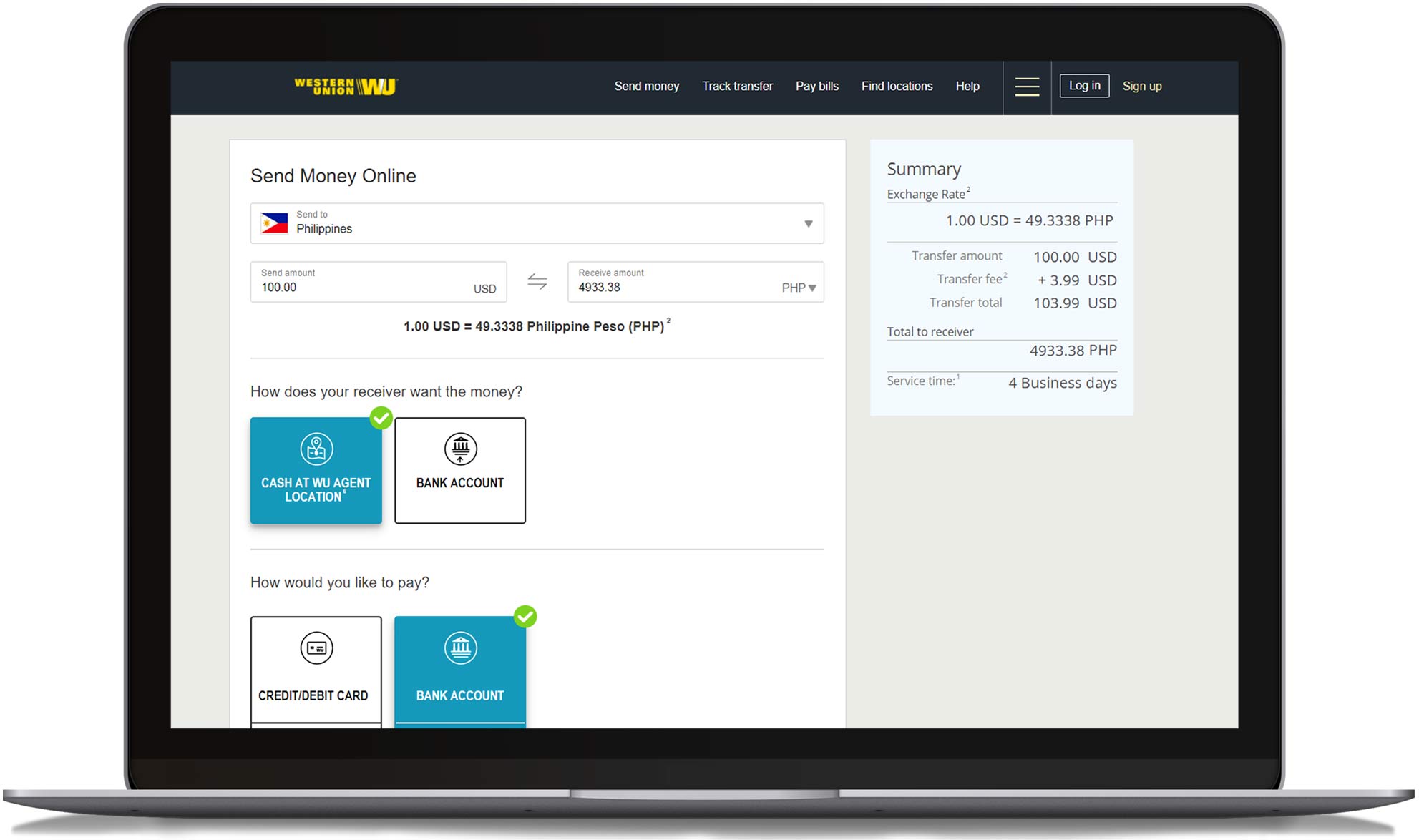

Because many of the banks operating in the philippines also have overseas branches you may be able to open an account more locally before you set off.

Founded in 1851 and known as the oldest bank in the country as well as southeast asia bpi currently has over 800 branches and 3 000 atms and cash deposit machines nationwide.

Security bank corporation is a proud member of bancnet security information.

My top choice in this list.

There are only two completely virtual banks in the philippines that do not have traditional branches.

We are currently experiencing difficulties in the delivery of isave atm cards.

No maintaining balance required.

Bpi has many branches located in the philippines making it easy for anyone to open an account with them and jumpstart their savings all for only 200 pesos.

Opening a security bank account has never been easier.

These are the dutch company ing and malaysian bank cimb.

However that doesn t mean you have to wait until you move to get started.

Maximum deposit insurance for each depositor is p500 000.

Read and accept terms and condition.

For a minimum deposit of 1000 your atm card will be sent to your registered present address within 5 7 banking days for metro manila and 10 15 banking days for provincial areas.

Due to documentation requirements it isn t possible to open a philippine bank account online.

Ease of account opening.